-

TrendsPublications and Reports

The instability and insecurity caused by significant global events are now a mainstay in the context in which large organizations operate. The “permacrisis” comes along with the simultaneous occurrence of several catastrophic events, leading to a scenario of “polycrisis,” in which companies must face risks feeding back each other, forcing them to stop focusing on strategic matters and to shift the focus to the current situation. The challenge for any brand is to combine the urgency of day-to-day management, which forces them to focus on the present, without setting aside future concerns.

LLYC has analyzed more than 200,000 conversations on social media over the past year to understand how seven global major risks currently threaten the reputation of different brands in the main sectors of Spanish economic activity. These should be assessed properly (based on their impact and probability) and managed to prevent what Warren Buffet once said “it takes twenty years to build a reputation and five minutes to ruin it.” The main conclusions can be found in the report “Reputational management system designed to face the seven emerging major risks.”

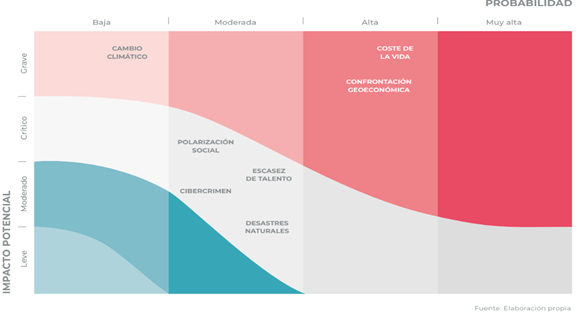

The seven major risks analyzed are: the cost of living, geoeconomic confrontation, failure to mitigate climate change, social polarization, cybercrime, talent shortage and natural. The analysis focuses on the food, distribution, real estate, transport, banking, energy, industry and infrastructure sectors when assessing the consequences of these major risks. Why have these sectors been chosen and not others? Because they are the ones that could potentially suffer the most impacts or the ones with the most interesting insights. LLYC has managed to accurately measure the probability of each risk resulting in a reputational crisis and their impact with artificial intelligence systems.

All of the risks analyzed have a high potential impact -critical or major-. This means that the materialization of any of these risks will turn into something more than just an incident, if not a reputational crisis. In addition, three of them (climate change, geoeconomic confrontation and cost of living) have the potential to become a major reputational crisis for the brands involved.

How should companies face major risks?

The decision-making bodies of companies need to focus on building reputational resilience. The following three steps must be included in the strategy to protect an organization against any reputational risk, and not only those mentioned in this report: anticipation, preparation and resolution.

1.- Cost of living

The cost of living stands out above all other risks, due to its sudden appearance and its urgency. Even though it is considered that it will have a limited duration – it is estimated that it will improve in a couple of years – its persistence will have the biggest impact on the most vulnerable sectors of the population, generating unrest and political instability. Companies in the food and beverage sector are among the most exposed to this risk materializing because the public sees a certain contradiction between what companies say and what they do. Society sees how the profits of these companies grow, while inflation suffocates family economies. Meanwhile, companies defend themselves by arguing that their margins are not growing. This example can be extrapolated to other sectors and constitutes a risk with a high probability of occurrence and a high impact on reputation due to the loss of consumer confidence in brands.

2.- Natural disasters

Floods, heat waves, droughts and other weather phenomena that can become natural catastrophes are all part of one of the risks considered to be one of the most serious in the next two years. Facing this risk is a complex task. The brands with the highest level of exposure at the reputational level are those operating or associated with the energy, transport, food or distribution sectors, since there is a moderate probability that this risk will materialize in a shortage of energy sources and products. We must bear in mind that these conversations fluctuate a lot, since lots of people talk about them when these events occur but they are followed by a lack of attention shortly afterward. In addition, the volume of communities talking about these events fluctuates greatly, depending on the nature of the weather phenomenon, whether extreme or not. When these weather phenomena occur, they have a very high impact potential. The way in which companies respond to these events is key to avoiding the associated reputational risk. Leading brands of the distribution, food and energy sectors are reaping the reputational rewards of the actions rolled out to mitigate this risk.

3.- Geoeconomic confrontation

More and more stakeholders are asking companies and CEOs on to give their views on different social and geopolitical issues and state where they stand. The Russian invasion of Ukraine is one of the best examples. Ending trade relations with Russia, despite the financial cost it entailed for some companies, was almost a necessity to continue operating in the democratic international market. As we have seen from the first half of 2022, one of the most affected sectors is the energy sector, but so are the transport, auxiliary construction, chemical, metallurgy or fishing sectors. According to the results of LLYC’s assessment, it is highly probable for the geoeconomic confrontation risk to materialize in the case of brands operating in the energy and distribution sectors. The supply crisis caused by the Russian invasion of Ukraine at the beginning of 2022 is a very good example of how the confrontation between countries has had a direct impact on the global supply chain. In our globalized world, countries have a high dependence on certain products and self-sufficient nations do not exist. Therefore, according to the chart prepared after an extensive data analysis process, the materialization of this risk in the energy sector would have a major impact across the globe.

4.- Failure to mitigate climate change

As each year passes, there are more and more pledges and commitments to combat climate change, but they do not seem to match the expectations. In fact, not all countries have the same tools and will to meet the goals, which increases overall mistrust. The actors most affected by this risk are public administrations, political groups and energy companies or the food sector, which all set out official goals to reduce their environmental impact. Of the sectors analyzed from the online conversations, food and distribution are the ones with the highest degree of exposure, although the probability of this risk materializing is medium and the reputational impact, if the risk were to materialize, moderate. This situation does not mean that the risk does not exist. Many institutions, brands and companies publish their sustainability reports on a regular basis, which balance stakeholder expectations around the risk of failure to slow down climate change. However, we must bear in mind that rambling on about sustainability can also become a risk if our stakeholders consider that our words do not match our actions, which is also known as greenwashing. This is a bad practice that concerns more and more brands and which is starting to have the opposite effect in some brands: greenhushing. In other words, deliberately not communicating environmental initiatives, for fear of being accused of greenwashing.

5.- Social polarization

Social media are the perfect place for analyzing this major risk, i.e., it is the window in which society expresses their views on the political, economic or social situation, and which leads citizens to propose drastic solutions and seek extreme positions for what they feel is an extreme situation. Financial institutions and flagship companies in key sectors, such as the energy, food and distribution sectors, continue to generate profits despite the crises, and they receive social criticism for this, which is the main source of reputational risk. The energy sector is the one in which this reputational risk is most likely to materialize. Given its strategic nature, the energy sector usually appears in conversations with political content (“energy poverty,” “growing inequalities,” etc.). However, the major risk of polarization would have a greater impact on other sectors if it were to materialize. In particular, it would have a huge impact on the transport and banking sectors.

6.- Cybercrime

The growing dependence on digital systems has drastically changed the way in which many societies function in recent years. In an increasingly digital and connected world, cyberattacks have the perfect environment to demonstrate the potential of their risks and the effects of their actions. The data analysis shows that the major risk of cybercrime is very likely to materialize in the banking, transport and energy sectors, despite being a moderate risk. Banking is the sector in which this risk has the greatest potential impact. Cyber attacks on banking institutions have a direct impact on customer trust, since they may lose their life savings and will ask their entity to be held accountable for lack of protection.

7.- Talent shortage

Currently, there is a lack of expertise in new fields of knowledge. There is a clear mismatch between technological progress and workers’ skills/experience. The shortage of talent worries 96% of global CEOs and 80% of Spanish businessmen. Of the sectors analyzed, the real-estate sector is the one in which this risk has the highest probability of materializing, due to the fact that conversations frequently address low-skilled labor and/or the fact that this risk is associated with dropping out from school, although there is a moderate impact of materialization. However, the transport sector is drawing attention to its situation. There is a moderate probability of materialization of these risks, but if they do materialize, they will have a major impact. In fact, the labor instability in some companies is the main reason for a shortage of talent in this sector. Workers’ complaints and demands have a high potential to make an impact and influence companies, which can lead to a major reputational impact. For example, this is the case of pilots or distribution or transport company workers going on strike, who disclose labor instability or are fighting for better labor conditions in public.

Click here to read the full study.