-

TrendsAchievements

-

CountriesGlobal

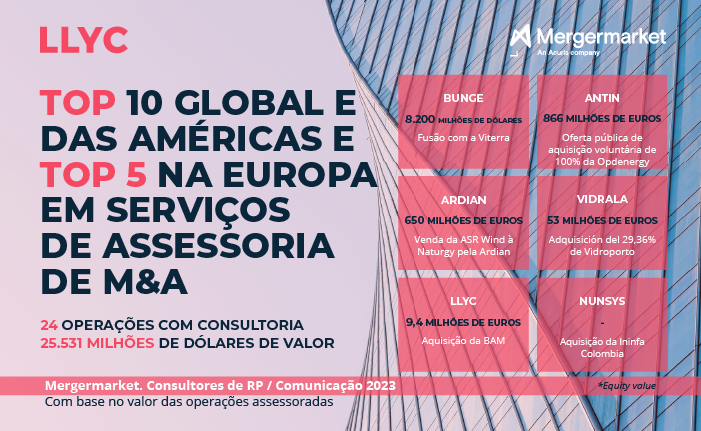

LLYC has closed the first half of 2023 in the global TOP 10 of M&A communication advisors by deal value, according to the official rankings published by Mergermarket. A milestone that has been achieved thanks to the computation of the transactions advised by the firm in the first six months of the year, amounting to a total of 24 operations for a total of $25,531 million.

Among the main transactions advised, the merger of the American group Bunge with its Canadian rival Viterra ($8,200 million), the voluntary takeover bid for 100% of Opdenergy launched by Antin Infrastructure Partners (€866 million) or the sale of ASR Wind to Naturgy by Ardian (€650 million) stand out.

In addition, Mergermarket has also confirmed LLYC’s leadership in the geographic areas in which it operates. Thus, by value, it tops the ranking in Spain (14 transactions valued at $4,656 million) and Latin America (five transactions valued at $3,427 million), is #4 in the European ranking (21 transactions valued at $22,148 million), being the only Spanish consulting firm in the TOP 5 corresponding to this geography, and the only one that appears in the TOP 10 of the Americas, occupying the eighth position (eleven transactions valued at $23,273 million).

International leadership of FGS Global, partners of LLYC

In addition, it is important to highlight the leadership of FGS Global, an international communications consultancy with which LLYC is associated and with which it develops cross-border projects. The firm closes the first half of 2023 as number 1 worldwide by number of operations (116) and second by value ($175,328 million), an outstanding position that they also achieve at European level, and in key countries such as the United Kingdom or Germany.

“Beyond the fluctuations of the activity derived from the current context, LLYC has consolidated its position as a reference advisor for M&A operations at a global level. The firm’s ability to involve specialists to cover all the potential needs of a transaction in its different stages and the capacity to deploy local teams in the main financial markets has been key,” explained Luis Guerricagoitia, Partner and Senior Director of financial communications.