-

TrendsEconomy

-

SectorOthersPublic Administration

-

CountriesPortugal

The Portuguese Government submitted today its proposal for the State Budget for 2026, one day ahead of the deadline and three days before the local elections. Although the Government is pretty much the same as last year’s (even though there was an early election last May), the political context today is completely different. A year ago, there were no guarantees that the Budget would pass, while today there are many candidates to help it be approved, even if the Government still lacks a majority.

The strategy of the Prime Minister and his team was to submit a minimalist document, making it easier to please potential parliamentary partners.

Although there are fewer risks this year of having the State Budget blocked in Parliament, the Government opted also to follow the same strategy of freezing most tax hikes and again reducing the Personal Income Tax, thus boosting internal consumption. The strategy proved correct last year, and in 2025, the Bank of Portugal forecasts a higher GDP growth thanks to just that.

This year, though, the State Budget doesn’t legislate on most of those sectoral measures. They have been discussed and approved individually in Parliament in the last weeks, and the State Budget, while reflecting their budgetary impact, doesn’t directly legislate them, as used to be the norm in the last decades. This way, the Budget is this year a more financial document and has fewer “budgetary knights”, as these measures were called.

This is something that the Finance Minister has been defending in the last few years. “Our goal is for the wording of the law to deal exclusively with budgetary matters. The annexed tables reflect political decisions, but each public policy – when it falls under Parliament’s competence – is discussed separately”, he said in the press conference following the Budget’s submission.

But it also comes in very handy to ensure political approval in Parliament. The Socialist Party has been saying that some “red line” areas couldn’t be included in the Budget for them to vote in favour of it. One of the red lines is the labour law changes that the Government has presented and that are currently under discussion. The other has to deal with healthcare and with the public national health service. This way, the slimmed 2026 Budget doesn’t cross any limits and makes it easier for the Socialists to approve it.

Chega, the biggest opposition party, has yet to clarify its position regarding the vote on the Budget. With the apparent support of the Socialist Party, their vote will no longer be key for the Budget’s approval.

Montenegro and his team are once again promising fiscal responsibility, with a forecasted budget surplus of 0,3% this year and another one, although smaller, in 2026 (0,1%). The Finance Minister has said that room to approve new measures during the discussion in Parliament is narrow – with a ceiling of only €230M, which is the expected surplus for next year. “If the country doesn’t want to have a deficit next year, the margin is close to zero”, he warned. The GDP should grow by 2% this year and by 2,3% in 2026. The Council of Public Finances warns that the Government’s forecasts are “optimistic”.

The goal is also to lower the public debt, from an expected 90,2% of GDP by this year’s end to 87,8% in 2026, and protect Portugal from outside shocks.

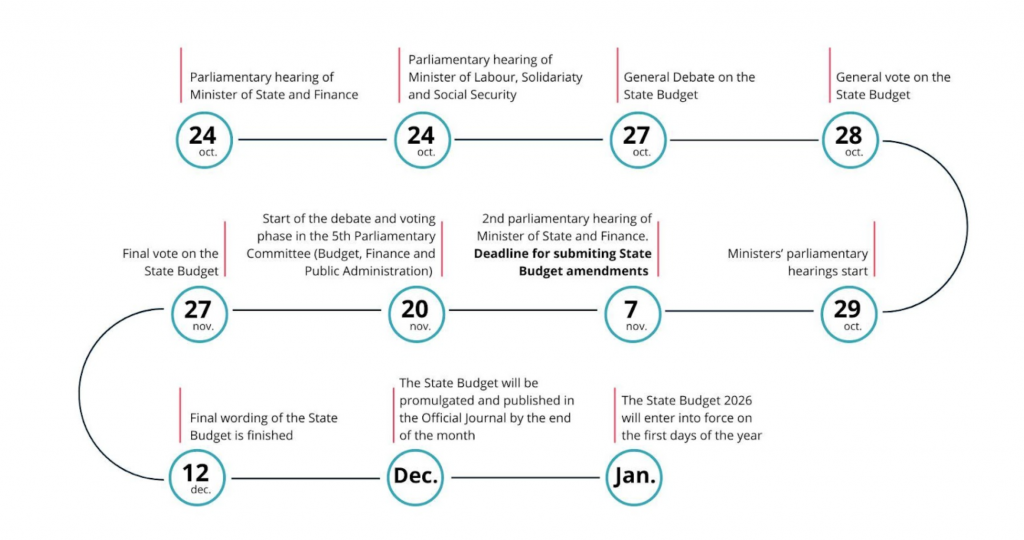

The discussion of the Budget takes place at the end of the month, with the general vote scheduled for October 27th.

RIGHT-WING PARTIES APPLAUD “RESPONSIBLE” BUDGET, LEFT ASKS FOR MORE MEASURES AND POLITICAL AMBITION

Hugo Carneiro, MP of the biggest party that supports the Government, the Social Democratic Party (PSD), applauded the strategy of asserted that the negotiation margin is “very limited”, appealing to parties to show a “sense of responsibility” by avoiding changes that would distort the budget surplus or jeopardize the execution of the Recovery and Resilience Plan (PRR).

The junior coalition party, the Christian Democrats, also noted that the 2026 State Budget includes the third consecutive surplus for the first time in Portuguese democracy. Parliamentary leader Paulo Núncio publicly reinforced the Government’s fiscal position, urging “political responsibility” from the opposition during the 2026 State Budget negotiations.

Following the submission of the 2026 State Budget proposal, Chega (CH) President André Ventura said that the party will not tolerate an increase in fuel taxes. Ventura considers that “the Government is forecasting an extraordinary consumption of fuel next year”, despite the guarantees of the Minister of Finance that the Government is studying a solution to avoid price hikes.

The Socialist Party (PS), led by José Luís Carneiro, signaled a willingness to enable the budget’s approval, confirming that the Government met key PS demands (including those related to labor, the National Health Service, and public Social Security). Although emphasizing that the proposal is not the PS’s ideal document, Carneiro committed to honoring the party’s promise to “contribute to political stability”.

The Leader of the Liberal Initiative (IL), Mariana Leitão, criticized the Government’s proposal for the 2026 State Budget. For the Liberal leader, the document “is not ambitious” for the Portuguese people, being “a greedy budget for the State“.

Criticism is widespread within the rest of the left-wing parties. Livre (L) denounces the “lack of political ambition”, arguing that the Government’s proposal presented today “contains no measures”. Meanwhile, the Portuguese Communist Party (PCP) takes an even more critical stance, accusing the Government of “exacerbating fiscal injustices” due to the reduction in Corporate Income Tax. Accordingly, the communists are adamant in expressing their “total opposition” to the Government’s proposal. PAN adopted a more friendly position, simply accusing the Government of not negotiating this first version of the State Budget, and promising that it will “present proposals to strengthen it”.

These are the next steps of the State Budget for 2026 in Parliament:

Below, we outline the most important measures included and considered in the 2026 State Budget proposal.

MEASURES AND INCENTIVES FOR COMPANIES

Corporate tax reduced again to 19%

The Corporate Income Tax (IRC) will be reduced by 1 percentage point to 19% next year, as outlined in the electoral program presented by the AD during the May elections. This measure, which represents an impact of €199M on public finances, had already been approved in Parliament in general terms in September, with the support of the CH and the opposition of the PS.

In addition, the Government intends to introduce a reduction in the tax rate applicable to Small and Medium-sized Enterprises (SMEs) and to small and mid-cap companies, lowering the rate on the first €50,000 of taxable income to 15% (also a decrease of 1 p.p.).

Main programme to promote R&D no longer accepts investment funds

The Government plans to specifically phase out the SIFIDE programme for investment funds, to generate savings of approximately €124M in 2026, potentially reaching €179M by 2030. Despite the termination of the benefit, the period for deducting already accumulated tax credits will be extended from three to five years.

This decision follows the recommendation of the Technical Unit for the Evaluation of Tax and Customs Policies (U-TAX), which highlighted that a significant portion of investments made through SIFIDE remained trapped within funds and target companies, without being effectively applied to R&D activities.

Productivity bonuses remain tax-exempted

The tax exemption under IRS and Social Security for productivity bonuses, performance-based rewards, profit-sharing, and year-end bonuses will remain in effect in 2026, provided that these do not exceed 6% of the employee’s annual base income. This measure, introduced last year by the first Government led by Luís Montenegro, will continue to apply throughout the coming year.

Support for technological and business innovation

The 2026 State Budget provides for the transfer of a total of €6.6M to the National Innovation Agency, in addition to €1M from Turismo de Portugal to NEST. These funds are intended to promote technological innovation and business digitalization, with an impact on the modernization of the financial sector.

MEASURES AND INCENTIVES FOR FAMILIES

Personal income tax to decrease again for lower brackets

The Personal Income Tax (IRS) will be reduced by 0.3% in the marginal rates from the 2nd to the 5th bracket, as previously agreed in this year’s State Budget. This marks the 4th time a Government led by Luís Montenegro has implemented a reduction in the tax burden. Additionally, the IRS brackets will be updated by 3.51%, which will benefit the 1st bracket by raising the technical threshold for salaries exempt from taxation to match the increase of the minimum wage. Despite the IRS reduction, the Government expects to raise an additional €937M in IRS revenue, owing to the projected favorable developments in the labor market.

Minimum wage increases to €920

As previously announced, the national minimum wage will rise by €50, reaching €920 per month. This increase was already stipulated in the agreement signed between the Government, employers’ confederations, and trade unions, and aims to gradually reach €1,100 per month by 2029. Despite warnings from the Minister of Labour, Solidarity and Social Security, who cautioned that the intermediate values set out in the agreement could be subject to change, the Government upheld the original plan, primarily benefiting Portuguese workers in the 1st IRS bracket, who remain exempt from paying income tax.

Public servants to receive a minimum increase of €56.58

The Government confirmed that public sector employees will receive a minimum increase of €56.58 (+2.15%) in their monthly income in 2026. In addition, the public sector minimum wage will rise to €934.99, exceeding the national minimum wage set for 2026 (€920). According to the Government’s proposal, this measure will have an impact of over €500M on public finances, benefitting more than 760,000 workers. Although this increase was already included in the agreement signed last year with social partners, unions had anticipated higher raises and have already called a nationwide public administration strike for October 24.

Pensioners with increases in 2026, but extra hikes aren’t guaranteed

The Government’s proposal for the State Budget partially focuses on the older population, a segment of the electorate that has traditionally been more distant from the PSD. The Government will implement the increases mandated by law, raising lower pensions (up to €1,045) by 2.7% (the only group to get a raise above the inflation rate). The 2nd pension bracket (up to €3,135) will see an increase of 2.11%, while the 3rd bracket (up to €6,270) will rise by 1.86% next year. These increases do not include the extraordinary raises proposed by PS and CH, which the Finance Minister considered could lead to a budget deficit.

The Solidarity Supplement for the Elderly will also increase to €670, a €40 increase from the current amount, benefiting approximately 230,000 pensioners. This measure alone will have a fiscal impact of €700M.

Taxes on alcohol and tobacco remain unchanged in 2026

The Government is forecasting to collect €80M more than in 2025 from the tax on tobacco and the tax on alcohol and alcoholic beverages, even if taxes remain unchanged. Revenue from the tobacco tax is forecasted to grow by €71M (+4.4%, totaling €1,6B), and revenue from the Tax on Alcohol and Alcoholic Beverages (IABA) by €8M (+2.5%, totaling €317M), following the trend observed in 2025. Nicotine pouches will be included in the list of tobacco and nicotine products that will pay excise duty from 2026. The tax rate is €0.065/g.

MEASURES FOR ENVIRONMENT AND ENERGY

More money and acceleration of licensing for renewables

As advocated in previous years, the Government reinforces its commitment to the energy transition, allocating close to €2.5B, a 4.9% increase compared with 2025. The Government also reaffirms its intention to launch a one-stop licensing platform for renewable projects, while also ensuring the approval of the Sectoral Program for Renewable Energy Acceleration Areas, aimed at simplifying and expediting renewable project licensing procedures. In addition, the proposal foresees a reform of the public institutions responsible for licensing, in order to ensure greater coordination and digitalization of processes. The Government will also abolish the Extraordinary Contribution on the Energy Sector (CESE) for natural gas companies, since it was considered unconstitutional by the Constitutional Court, but will maintain this tax for other companies of the energy sector.

Investments to ensure a more resilient and independent power system

Following the April blackout, the Government is also prioritizing the robustness of the energy system, increasing investment to modernize the grids, expanding the number of solar plants with black start capability, and promoting energy storage and interconnections within the Iberian and European frameworks. At the same time, the Government plans to boost renewable energy production, promote the electrification of consumption, and stimulate the renewable gas market.

Agrivoltaics and ocean energy at the forefront of the green industry

In line with the Clean Industry Pact presented by the European Commission, the Government announced the development of a Green Industrial Strategy aimed at creating stronger synergies between economic sectors through the promotion of agrovoltaic projects and ocean energy production.

No tax increase on petroleum products for now

Despite pressure from the European Commission, the Tax on Petroleum Products (ISP) is not expected to undergo any changes. However, a gradual reduction in taxation has been promised for a period when crude oil prices are lower, to avoid significant impacts on consumers.

In the field of mobility, the Government also intends to expand the electric vehicle charging network next year and further promote electrification. In addition, the Executive will advance the decarbonization of the fleet of public transportation, with plans to acquire electric and hybrid public transport vehicles, such as buses and ships.

More investment in sustainable water management by 2030

Recognizing water resources as a priority, the proposal for the State Budget aims to enhance water efficiency through the “Água que Une” plan, which includes measures such as investments to ensure supply security, modernization of the National Water Resources Information System, and environmental enhancement of riparian areas. This strategy also encompasses the approval of the new Action Plan for the Circular Economy, which will be implemented by 2030, as well as the strengthening of the TERRA Action Plan, aiming to expand waste treatment capacity and address the growing risk of landfill capacity reaching its limit.

MEASURES FOR HOUSING

Public guarantee and tax exemptions remain in place

To facilitate access to first-time homeownership, the Young IMT scheme, which exempts the taxes associated with purchasing a property for people up to 35 years old, will be continued. With the update of the IMT tax brackets, the properties that benefit from this exemption can now be worth up to €330K. The Public Guarantee for Young Housing, which eases access to credit via a State Guarantee that also covers the down payment in the mortgage, is also maintained in 2026. It has a total of €1Bn.

Public housing supply with a boost of up to €930M

The Government identifies the shortage of available housing as the main driver of the current housing crisis and aims to curb rising prices by increasing the number of homes on the market. On the public side, €930M have already been earmarked for 2026 under programs focused on housing promotion and rehabilitation, expected to benefit around 22,000 people. Meanwhile, the Government also pledges to mobilize public assets, from land to buildings, for new housing projects.

Students housing market set to receive investments

The Government is set to overhaul the higher education social support system by 2026/2027, focusing on transparency and broadening access to academic housing beyond traditional criteria to include economically vulnerable students. This initiative will be supported by continued investment in student residences via the using funds from the Recovery and Resilience Plan (PRR), alongside efforts to regulate the informal student rental market and plan for long-term accommodation capacity, within the framework of the National Plan for Higher Education Accommodation.

Rental market regulation defines €2,300 as moderate

To reinforce stability and security within the rental market, the Government plans to introduce new legislation and promote the expansion of affordable rental options. This will include an increase in the number of contracts under the accessible rent scheme, helping to ensure more predictable and fair conditions for both tenants and landlords. This intention has fueled controversy, as a “moderate rent” is defined as up to €2.300.

MEASURES FOR THE DIGITAL ECOSYSTEM

Cybersecurity is enhanced with NIS2 transposition

With cybersecurity as a priority, the Government plans to strengthen the legal framework and public policies by the end of 2025, through the transposition of the NIS2 Directive and the revision of the legal regime for cyberspace security. Three key instruments will be created on this occasion: the new National Cyberspace Security Strategy, the National Plan for Responding to Cybersecurity Crises and Incidents, and the National Reference Framework for Cybersecurity.

Government appoints a CIO as part of the State Reform

A Simplification Program, part of the State reform, has the goal to combat bureaucracy through two strategic objectives: increasing administrative efficiency and reducing costs for citizens and businesses. Noteworthy measures include the creation of the State Chief Information Officer and the Digital Agency, which will coordinate a unified digital strategy; full interoperability of public systems; and the creation of a single digital interface platform.

New digital technologies for the Public Administration

The Government aims to strengthen the public servants professional development and requalification, in line with the reorganization of ministries and the adoption of new digital tools. The goal is to increase agility, innovation, and efficiency in public services by promoting access to updated, free, and online training opportunities for all employees and managers. The modernization of infrastructure and technological systems is essential for the digital transformation of the State and to ensure the “once only” principle, preventing citizens and businesses from having to repeatedly submit data. The adoption of urban platforms and digital twins will enable smarter and more sustainable territorial management. This modernization is based on a national data policy that promotes sharing and evidence-based decision-making.

Strengthening the qualities of public service

The Government wants digitization to translate into a real improvement in the experience of citizens and businesses, enhancing the quality and accessibility of public services, both digital and in person. It seeks to provide integrated services through the Gov.pt portal and app, expanding its territorial coverage. The commitment also includes the expansion of electronic identity and digital mobile keys, promoting a more accessible, efficient, and people-centered State.

Artificial intelligence as a driver of modernization and transformation

The Government will allocate €20M to promote the adoption of artificial intelligence in Public Administration as a driver of innovation, efficiency, and modernization of public services. This investment will support the development of the multimodal Portuguese language model, the integration of the Gov.pt virtual assistant into the mobile application, and the implementation of AI solutions in areas such as public procurement, invoicing, and the management of EU funds.

Promoting digital skills as a pillar of the digitization strategy

The Government aims to invest up to €2M to promote the development of digital skills among citizens and workers, contributing to making digitization more inclusive and equitable. The goal is to empower the population to take advantage of technological opportunities, reduce inequalities, and strengthen employability by increasing the percentage of citizens with basic digital skills and ensuring universal access to digital services.

MEASURES FOR THE FINANCIAL SECTOR

Banks still have to pay a contribution but will no longer fund Social Security

The extraordinary contribution to the banking sector will remain in force in 2026 and will amount to €210M (the same as 2025). The specific contribution applied to financial institutions remains, but on the other hand, the additional contribution that banks had to pay to fund the Social Security, which amounted to €40M in 2025, will be terminated in 2026, after the Constitutional Court ruled it to be unconstitutional.

Maximum limits for the granting of guarantees

The Government is authorized to grant State guarantees up to a maximum annual net flow limit of €4,5B. Additionally, the Government is authorized to grant guarantees of up to €2.6B, covering export credit, financial credit, and Portuguese investment abroad. This measure aims to support the internationalization of companies and reduce risks through the strengthening of Banco de Fomento (the Portuguese Development Bank).

Granting of loans and other active operations

Active operations of up to €6B are authorized to support the economy, finance strategic investments, and strengthen corporate liquidity. These operations may be managed by Banco Português de Fomento, with a focus on financial sustainability and business competitiveness.

State-guaranteed credit insurance transferred to the Development Bank

The management of the State-Guaranteed Credit Insurance will be transferred to Banco Português de Fomento starting January 2026. This centralization aims to optimize the management of public guarantees and ensure greater efficiency in covering risks associated with exports and business financing.

Mutual counter-guarantee fund

The State authorizes guarantees of up to €1B in favor of the Mutual Counter-Guarantee Fund, strengthening the mutual guarantee system. This measure enhances support for the financing of SMEs and startups, promoting competitiveness, investment, and the responsiveness of the national business sector.

MEASURES FOR TOURISM & AVIATION

Promotion of Portugal as a tourist destination

The Government aims to consolidate Portugal’s position as a leading global tourist destination by supporting the international expansion of national tourism companies. These efforts focus on strengthening accessibility and connectivity, ensuring that Portugal remains an attractive and easily reachable destination for visitors. €442M are contemplated in this regard.

Increased development in Regional tourism

At a regional level, the Government is committed to promoting more sustainable mobility solutions between key tourist areas, making travel smoother and greener. This includes the development of eco-friendly rail connections, while also planning to improve efficiency in tourist transport services, such as airport to hotel transfers. A new Tourism Innovation Agenda will soon be launched, defining priority areas for innovation and outlining support programs for pioneering projects and startups in R&D.

Air connectivity to be expanded in 2026

Recognizing that connectivity is crucial for growth in distant markets, a specific program for air connectivity expansion will be launched in 2026, in coordination with national and regional partners. This program will incentivize the opening of new, economically sustainable direct air routes, strengthening the country’s link to the portfolio of source markets across various regions, through joint promotion agreements with airlines aimed at publicizing ‘Destination Portugal.’

Government doesn’t commit to any valuation of TAP amidst its sale

The Government chose not to include any estimate for the proceeds from the privatization process, but highlighted, in the introduction of the document, that the restructuring process of the TAP universe has been consolidated, and the reprivatization process for TAP has begun. When questioned about the fact that no value related to the privatization of TAP was included in the document, the Minister of State and Finance responded with the following: “Obviously, with negotiations underway, any value would influence those negotiations. The sale will not have an impact on the budget balance.”

Lisbon and Porto airports will receive investments

The Government is pursuing a two-pronged investment strategy: the continuation of the development of the new Lisbon Airport – Luís de Camões, which is crucial for alleviating saturation at Lisbon Airport and establishing one of Europe’s largest hubs. In parallel, the capacity and efficiency of the Lisbon and Porto airports are being reinforced with investments in terminals and infrastructure, with the goal of consolidating Porto as the reference choice in the Iberian Northwest region. These works are fundamentally aimed at improving international connectivity and boosting tourism and business, aligning with the country’s sustainable growth targets.

Roadmap for decarbonization

Within the scope of the Roadmap for the Decarbonization of Aviation, new incentives will be launched for the production of Sustainable Aviation Fuels (SAF), contributing to structuring a value chain at the national level. An incentive of up to €40M is already in place in this regard.

MEASURES FOR DEFENCE

Military Programming Law to be reviewed in 2026

The Government seeks to reverse an eight-year decline in personnel retention by reinforcing recruitment, improving allowances, and ensuring competitive salaries. Operational effectiveness will rely on preventive and corrective maintenance of military assets, while the 2026 revision of the Military Programming Law will align defence planning with strategic and budgetary objectives.

Spending in Defence will reach 2% in 2025 and more in 2026

The GDP share of defence spending will reach 2% this year and exceed 2% in 2026, the Finance Minister said. Priorities include cyberdefence, unmanned systems, AI, simulation, sensors, interoperability, and autonomous platforms. The strategy seeks to attract investment, boost production capacity, strengthen NATO-EU cooperation, integrate Portuguese industry into European programs and multinational consortia to foster dual-use technologies, and modernise the Armed Forces’ critical capabilities. SAFE loans must be settled by year-end, with 2026 expenditures financed by either the State Budget or SAFE.

Defence industry incentives to replicate the “OGMA model”

Consolidating the Defence Technological and Industrial Base is a key strategic goal, linking universities, research centres, and technology companies. The Government aims to move forward with legal reforms to promote public-private partnerships that mobilise national expertise and foreign investment in line with the “OGMA model”. Performance will be measured through economic impact, job creation, and the growth of Portuguese defence exports. The Government seeks to position the defence sector as a driver of economic growth.

MEASURES FOR IMMIGRATION

Migration policy reshuffled to reduce illegal staying

The Government has set in 2025 a migration policy grounded in the rule of law, responsible management of flows, and respect for human dignity. It aims to ensure regulated immigration that meets national needs while valuing the contributions of migrants. Enforcement of illegal entry and residence will be strengthened, guaranteeing legality, security, and full protection of human rights, with measures aligned to international standards.

AIMA’s modernization key for administrative efficiency

The Government set the transformation of AIMA as central to delivering an efficient, transparent, and reliable migration system. The new organizational structure, the Government says, will accelerate decision-making, reduce bureaucratic obstacles, and ensure faster processing times. By improving operational coordination and adopting digital tools, AIMA will provide clearer guidance, better integration support, and more responsive services for migrants.

Talent attraction and local integration

A strategic approach to attracting foreign talent will align with economic priorities and target sectors with labor shortages. Migration policy will emphasize shared responsibility, requiring employers to ensure dignified reception and integration conditions. The approach will be decentralized, involving municipalities, civil society, and the third sector.

MEASURES FOR FORESTS

Sustainable and resilient forests

Resources for wildfire prevention and intervention, fuel management, and protection of settlements will be strengthened. The Government also aims to reduce the impact of pests, diseases, and invasive species, protect native flora, promote indigenous species, increase national production and commercialization, and advance research and knowledge transfer, securing an adapted, diverse, and sustainable forest.

Rural territories, innovation, and irrigation

The Government seeks to enhance rural areas, stimulate entrepreneurship and innovation, and strengthen research, training, and knowledge transfer in the agroforestry, fisheries, and maritime sectors. Projects will be tailored to local needs, emphasizing gender equality, cooperative collaboration, expanded irrigation, and infrastructure modernization, ensuring productivity, resilience, and territorial cohesion.

Integrated management and territorial governance

The Government is committed to a more resilient, productive, and sustainable forest through active, professional, and streamlined forest management. The “Forests 2050: Greener Future” Plan includes 19 measures and 154 strategic actions. The Government will promote integrated action among the State, local stakeholders, and the private sector, clarifying responsibilities and reinforcing efficient governance models. The Government aims to promote a favorable environment for investment and innovation while fostering economic development, job creation, and territorial cohesion.