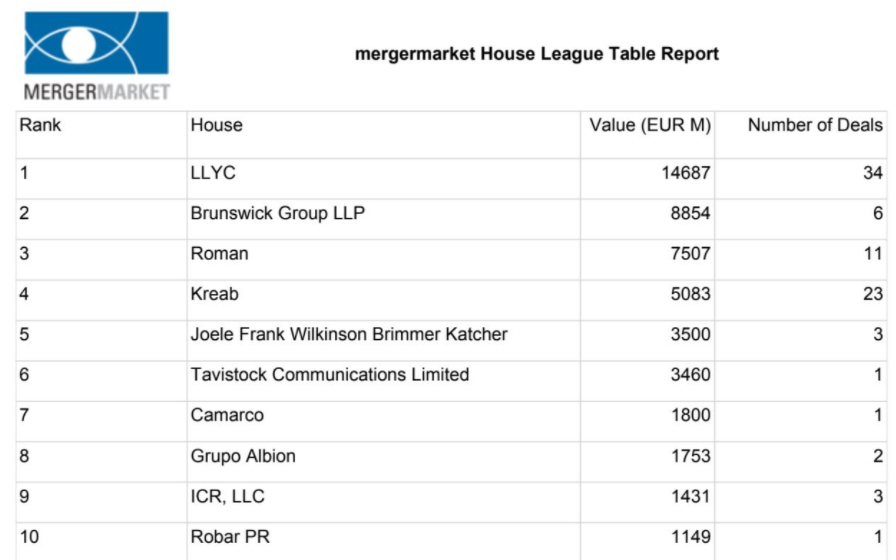

LLYC has closed off 2021 as the leading communication consultancy firm in Spain in mergers and acquisitions (M&A). It heads up both the number and the value of the deals advised on, according to data from the analysis agency Mergermarket. In total, 34 deals were advised, amounting to 14.69 billion euros.

*League table extracted from Mergermarket data on 20/01/2022, taking into account the deals contained on this platform for the period from 01/01/2021 to 31/12/2021 in which the target, seller or bidder was a Spanish company, in the case of the league table in relation to Spain, and those in which the target, seller or bidder was a European company, in the case of the league table in relation to Europe”.

Furthermore, at a European level, LLYC remains in the top 10 (9th position) in the number of deals advised on (44) and is ranked in the top 20 (16th position) in the value of these deals (16.57 billion euros). The firm is also ranked in the top 15 of the global league table by number of deals (12th position) and in the top 20 by value of the deals (17th position). In all the different league tables, it is the leading Spanish consultancy firm.

The LLYC financial communication team, headed up by Luis Guerricagoitia, has taken part in the communication process of the most important corporate deals that have been concluded in 2021, such as the partial takeover bid that IFM announced for 22.69% of Naturgy, the takeover bid by Kerry Group for 100% of Biosearch, the acquisition of the towers division of Telxius by American Tower, the acquisition of ITP Aero by Bain Capital, the sale of a minority shareholding of Codere Online to the Mexican SPAC DD3 Acquisition and the acquisition of Adamo by Ardian.

LLYC has also taken part in other major M&A deals which, although announced in 2020, took place last year, such as the merger between CaixaBank and Bankia.

Growth in listings on the stock exchange

Over the course of 2021, LLYC also consolidated its leading position in advice on listings on national and international stock markets. Among other deals, the firm, together with its partner FGH, accompanied Acciona in the launch on the stock market of its renewable energy subsidiary Acciona Energía – the largest stock market launch in Spain since 2015. It also advised the company of Spanish origin Allfunds in the notification of the initial public offering in its launch on Euronext Amsterdam and the firms AZ Capital and SJT Advisor in the launch of SPEAR – the leading listed SPAC in Europe – which has a Spanish sponsor.

The financial communication team also designed and implemented the communication strategy that accompanied the listing of LLYC on BME Growth, the first Spanish communication consultancy firm to be listed on the stock market.

“The economic recovery has reactivated a stronger market for corporate transactions than we would have initially expected. Furthermore, our role in these deals has been reinforced. Such elements as our ability to incorporate technology and creativity and our presence in the main financial markets through our alliance with FGH have allowed LLYC to bed down its leading position for the second consecutive half-year”, explains Luis Guerricagoitia, Senior Director of the Financial Communication Department at LLYC.

Leading position of our partner FGH

Finsbury Glover Hering (FGH) – the international communication consultancy firm that LLYC is partnered with in the development of multi-country projects, is also ranked in a top position on the ranking drawn up by Mergermarket, consolidating its position in the top 5 at a European and a global level in deals advised on.